I came across the book The Art of Frugal Hedonism by Australian authors Annie Raser-Rowland and Adam Grubb in which they talk about ways to enjoy the pleasurable things in life while remaining frugal.

Some ideas they discuss:

- Have a picnic instead of going to a restaurant

- Go out to restaurant, but avoid buying alcohol, just have a meal and water

- Have friends over and drink for a barbecue and a beer instead of going out.

- Find a cheap or free “third-place” (a place that’s neither work/school or home) that you can hang out at without spending much money – a park or community centre or local coffee spot.

I shan’t quote all their ideas because the book is worth a read - it’s quite easy and light to read anyway.

Some of these are common sense, but even so, it’s good to get one thinking about one’s spending and activities regardless.

TL;DR:

The Art of Frugal Hedonism by Australian authors Annie Raser-Rowland and Adam Grubb is a good book. Play with my app at money-choices.info and think about alternative spending for some given amount of money. Or plan a budget or more frugal night out.

Unit Cost Alternatives

I’m also interested in how you can spend less, but still do the same things, rather than just not spending at all. How can you get more value out of the same amount of money by buying things that better resonates with you?

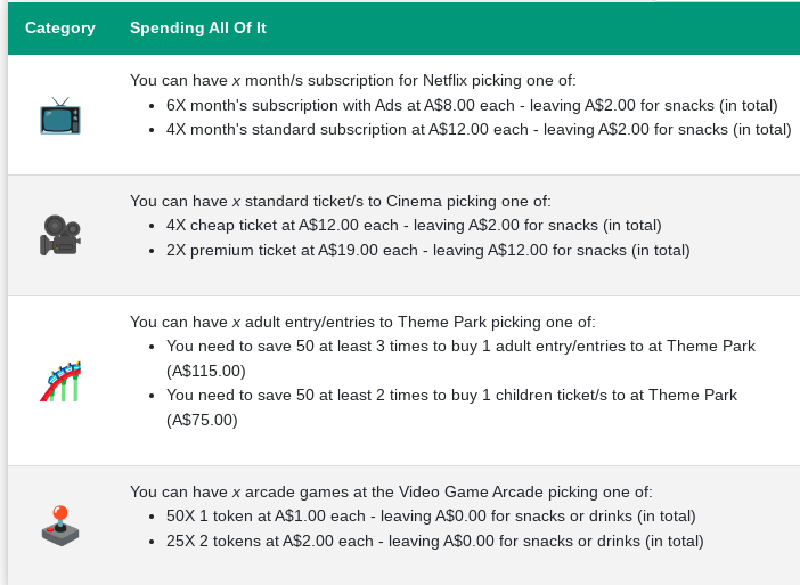

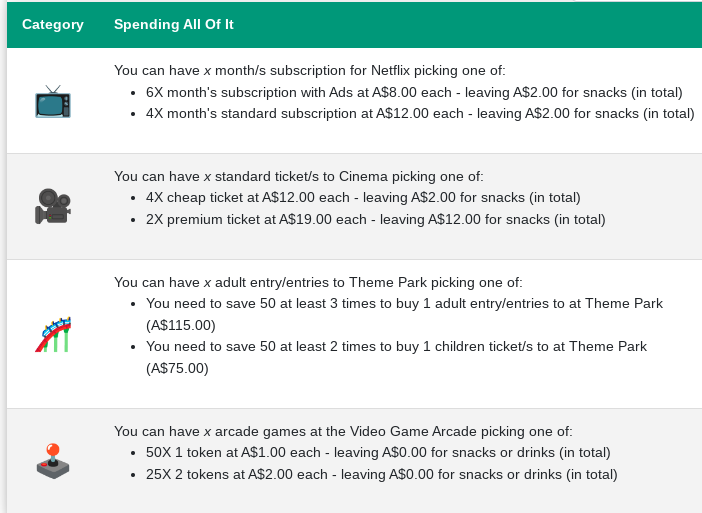

I can answer that with a personal project I’ve been building on and off for a year now. (Actually, I started years ago, but only got back to it recently.) My personal project is a calculator website where you can enter a spending amount and it can tell you how many different other items you could get for that amount. (See it now at money-choices.info.) For example, spending $50 on Entertainment could get you either:

- 6 months subscription to Netflix with ads OR

- 4 cinema tickets at $12 each

- BUT you need to save that $50 3 time to pay for a theme park ticket.

Thinking of your discretionary spending in unit costs could help to

decide if a certain cost is worth that money to you and your own values.

You might find that for the cost of a cinema ticket you could get a

month’s Netflix subscription which might be better value for you. Or if

you really like going to the cinema, then you could think about how to

spend efficiently on your pre-cinema drinks. My app does the same thing

with drinks too - so say you want to spend $20 on drinks before the

cinema you could choose either:

Thinking of your discretionary spending in unit costs could help to

decide if a certain cost is worth that money to you and your own values.

You might find that for the cost of a cinema ticket you could get a

month’s Netflix subscription which might be better value for you. Or if

you really like going to the cinema, then you could think about how to

spend efficiently on your pre-cinema drinks. My app does the same thing

with drinks too - so say you want to spend $20 on drinks before the

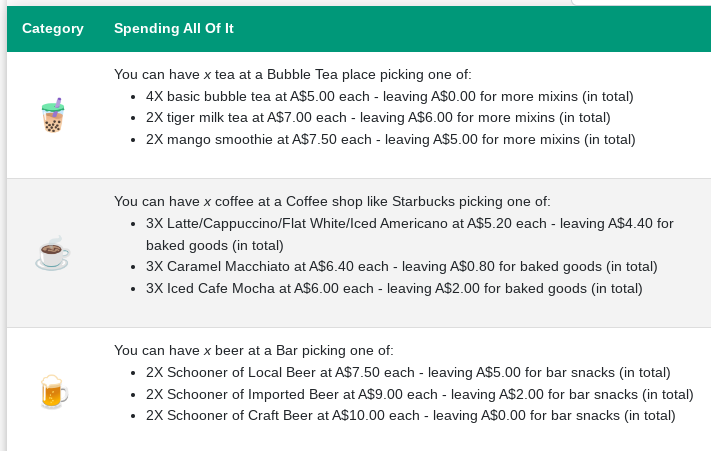

cinema you could choose either:

- 2x Tiger Milk bubble teas OR

- 3x Iced Cafe Mocha OR

- 2x Schooners of Craft Beer

Or of course, a mixture of these but I haven’t included that here.

While these prices are made up, they are not completely wrong (but may be out of date) - I based them off observed prices in my local area and used Microsoft Copilot to generate prices based on some price listing sites from 2020 - 2022.

You can view the site now at money-choices.info

Unit Cost Budgeting

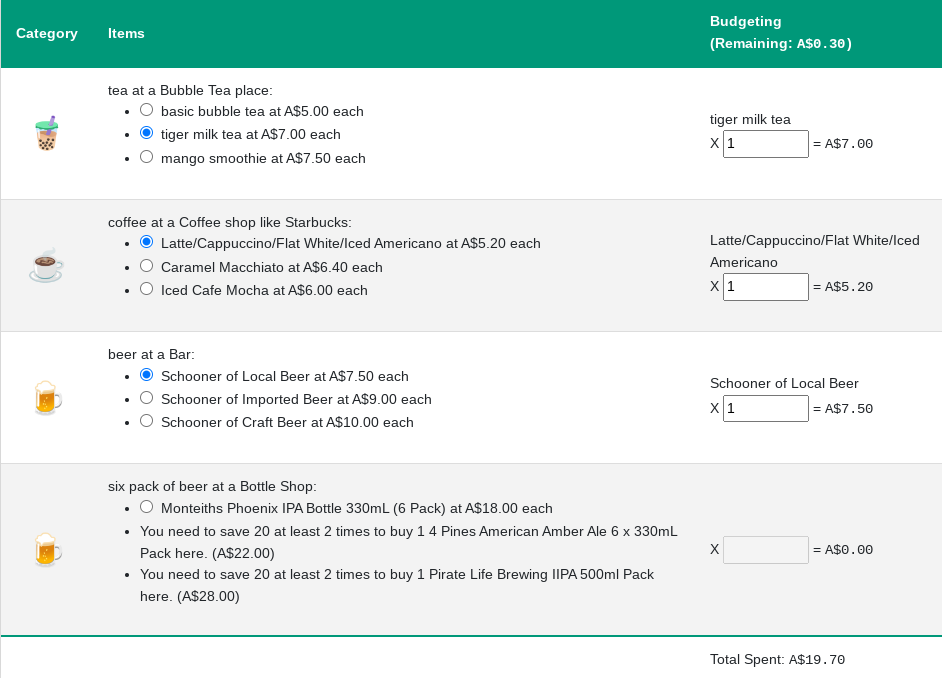

My friend was telling me that he was budgeting for drinks for the month, so I decided to take the same methodology and allow people to use it for calculating their budgets for that category. So you can estimate how many coffees you drink each week or month, how many beers you drink or bubble teas you enjoy and use that to calculate your spending. And of course I disable any options that you can’t afford at all.

Or work the other way and estimate spending or even create a spending plan for a scenario like the pre-cinema drinks from above.

So, to plan a pre-movie drinks evening, you could enter 1 of each - bubble tea, Latte, Beer spending $19.70.

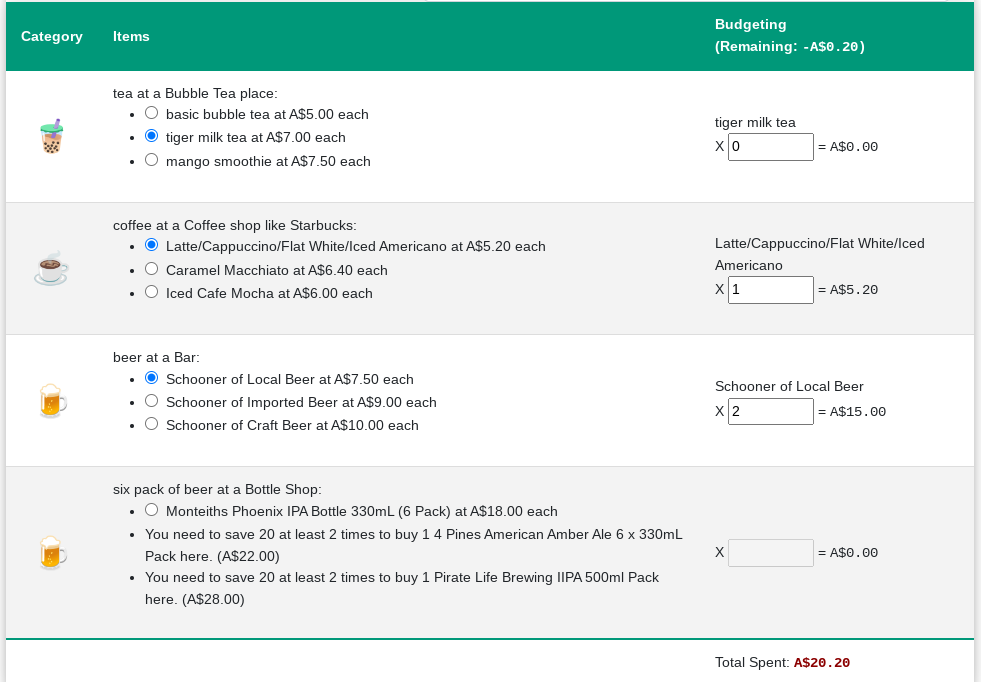

Alternatively, you may think you'll buy 2 beers and a hot chocolate in the cinema which would also put you close to or just above $20.

Of course, you don't have to spend all your budgeted amount, so you could instead buy either a beer or bubble tea, saving yourself about $7 - $10.

Whichever way you want to use this tool, have fun thinking about your spending choices.

You can view the site now at money-choices.info

Technical Development

I've been taught to do projects in an incremental way so that early in the development you have a workable prototype, then you can enhance it closer to the end-product as you go. I built the Unit Cost Alternatives in this way:

- I programmed the logic with totally static data.

- Then when I was happy with the logic and display, I extended to shared components, passing the static data around, just from the filesystem.

- Eventually I restructured the app to ease development and fetch the data on load.

At each step I had a working app for my own learning, and the next enhancement wasn't too onerous.

On my other blog, I have a short write-up of the user-experience iterations I went through. You can read that at my Projects Blog – Unit Cost Fun.

Making the budgeting part of this involved a lot of learning as I needed to learn how to correctly pass the React state up the application and calculate the totals, while not actually knowing what items there could be at design-time. I built the app in a way that I can just update the data and add more categories or items without changing the application logic, that was more challenging but more rewarding too. I ended up using a Map data-structure, maintaining the sub-totals in the parent object and the chosen item and quantities in the child objects for each category of spending.

Technical Resources

Following is a list of some resources I used:

- Map.prototype.set() - JavaScript | MDN (mozilla.org)

- JavaScript Map forEach() Method (w3schools.com)

- The 23 Best Web-Safe HTML & CSS Fonts for 2024 (hubspot.com)

- Map.prototype.set() - JavaScript | MDN (mozilla.org)

(Actually, I used a lot more in the research, but the unused Stack Overflow answers are irrelevant here!)